🌿Blue Sky Analytics - Building the Bloomberg for Environment & Climate Data

TLDR; Over $25T of assets are at risk from climate change & nature loss. BSA provides high resolution environmental analytics for stress testing, strategic planning, and portfolio management.

The problem: Financial institutions and corporates are facing an increasing number of risks from climate change - whether it be physical risks, or transition risks.

But these stakeholders lack the high resolution data they need to make the right choices about how to respond to all of these risks.

Like any business function, investing in the transformation of supply chains and portfolios to become more resilient to environmental change necessitates informed planning and careful strategising.

Perhaps one of the most cited frameworks to guide organisations to do this is the Task Force on Climate-related Financial Disclosures (TCFD), which provides a pathway for companies to assess and disclose information about climate-related risks and opportunities.

As awareness of climate-related risks has grown, what began as a voluntary set of recommendations has become a mandatory part of the regulatory framework in many jurisdictions. Take Singapore, for example. Since the start of this year, TCFD-aligned disclosures have become mandatory for listed companies in Singapore the financial, agriculture, food and forest products, and energy industries. It will soon grow to become applicable to materials and buildings, and transportation industries as well. The European Union, Canada, Japan and South Africa have similar requirements.

Additionally, market participants, including investors and credit rating agencies, are increasingly considering climate-related factors in their assessments, putting pressure on companies to address these risks.

To respond to these pressures corporates and financial institutions alike now need to model the impact of different scenarios on their businesses, and to develop the right strategies in response to those scenarios - Whether that be from flooding, wildfire, changing temperatures, and more.

The solution: With an automated & scalable “data refinery”, Blue Sky Analytics uses its proprietary environmental models to provide clients with the information they need to make critical decisions - all in one place.

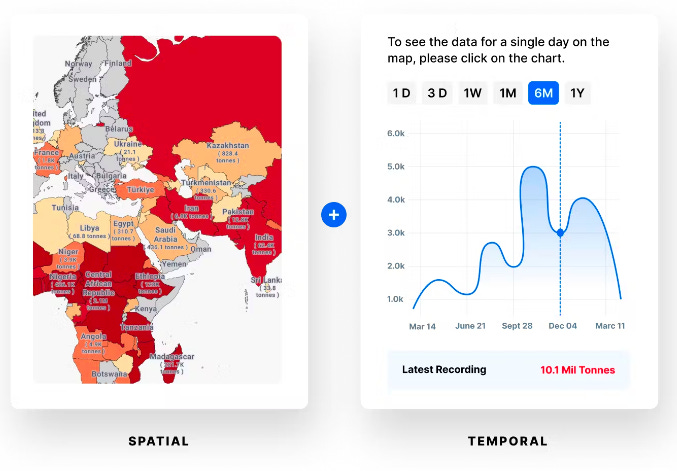

With Blue Sky Analytics’ AI-powered technology, SpaceTime™, users can explore and search through a variety of pre-processed, high-resolution and high-frequency datasets based on Earth Observation and transparent methodologies. Whether it’s through Blue Sky’s own platform or through API calls, Blue Sky’s customers can access real-time and forecasted data on all types of environmental data - whether that’s droughts, surface water quantity and quality, wildfires, floods, tree counts, carbon biomass, and more.

Meet the team: Bringing together industry experience with strong entrepreneurial drive, this award winning team has been recognised by Bloomberg, Fast Company, the European Space Agency, and the Indian President for its work on environmental action.

Biodiversity Accelerator+: Abhi, what was your vision for Blue Sky Analytics when you started the business? How do you think BSA differentiates itself from it's competition?

Abhilasha Purwar, CEO: My vision was honestly quite simple. The world of climate and environment is mired with words, but few numbers to hold us accountable. For instance, what is the year on year net decrease in carbon emissions, per nation, per city, per company ? What is the total carbon stock increment in a carbon project ? What is 1 yr, 5 yr, 10 yr probability of a wildfire instance to a house or a transmission line? The availability of numbers are far and between. Measurement methodologies were in early phases, in mostly academic domains, with very little standardization and transparency.

I had another thesis that if given the availability of tangible numbers to various stakeholders, action will be swift and transparent. And on the basis of these two fundamentals, I founded Blue Sky Analytics, to convert vast volumes of satellite data into accessible, spatio-temporal carbon, climate & environment intelligence. And the differentiation from competitors also lies in this focus on fundamental & transparent data parameters and goal to build a gold standard of measurement methodologies and intelligence catalogue.

Biodiversity Accelerator+: Chandru, you joined the management team a year ago after serving as their strategic advisor. What impressed you about the business that made you take that leap?

Chandru Badrinarayanan, COO: It was clearly the value proposition of a firm like Blue Sky Analytics, providing 'actionable' data and dMRV or Digital Monitoring, Reporting and Verification services, for Carbon Markets & for quantifying Climate Risk.

Having spent well over 3 decades in firms like MSCI and Crisil (an S&P company) and building high-growth, high-margin businesses, I understand the role of data and monitoring in bridging the trust deficit between various stakeholders and the premium offered by clients for the same. I saw the potential of commercializing the unique data and services of Blue Sky for a variety of use cases, as climate affects almost everything in the world. I am happy to say that we have found our Mojo to grow our business and starting to make a positive impact on the planet through our actions.

Biodiversity Accelerator+: What changes have been made to the business since Chandru joined?

Abhilasha: The business has become very focussed and targeted since Chandru joined. Chandru brought extensive experience & deep network to a rather young team. We understood what customer categories will be impossible to close, which will take too much time, which have complicated procurement processes, or which may not totally align with our product design or offerings. This allowed us to sharpen business into 3 focus areas - Carbon Markets, Asset Monitoring & Climate Risk Analytics; and enabled us to refine our focus customer segments - BFSI sector + Carbon Developers & Financiers.

Biodiversity Accelerator+: If you could ask for anything from our readers, what would it be?

Chandru: Try our work. Digital MRV can be accurate, insightful, economical, and can be deployed for a variety of use cases across the world, for both Natural Assets and Physical Assets. A client recently told us that she feels like a 'Kid in a candy shop' after seeing our work 😊

Abhilasha: If you are in the Carbon Space as a developer, or financier, we would love to chat and see how we can help in project planning and measurements.

Thanks for reading! If you are keen to learn more about Blue Sky Analytics, be sure to visit their website, and connect with them on Linkedin.

You can also learn more about the work we do to support entrepreneurs at the Biodiversity Accelerator+ at our website.