📊 Bringing Science to the Real World: 3 Frontiers in the Application of Nature Data

What we need to know about biodiversity and nature, how we can access that information, and why it matters.

Ask any ecologist, and they’ll probably tell you their work was driven first and foremost by a love and natural curiosity for the outdoors. Where some might find joy in learning and memorising the different calls and flight patterns of birds, others might be fascinated by the hugely diverse taxonomy of plants and fungi around them. Nature’s inspiration has driven many great environmentalists in their research endeavours, from Darwin to Sylvia Earle.

But the urgent and severe twin crises of biodiversity loss and climate change are making a clear need for robust nature data that goes beyond curiosity and passion. We need nature data that can drive informed, strategic action for nature on a global level.

Ensuring our nature datasets are robust and useful requires thoughtful planning of how data is collected, processed, and analysed, all according to the ultimate end goal and use case.

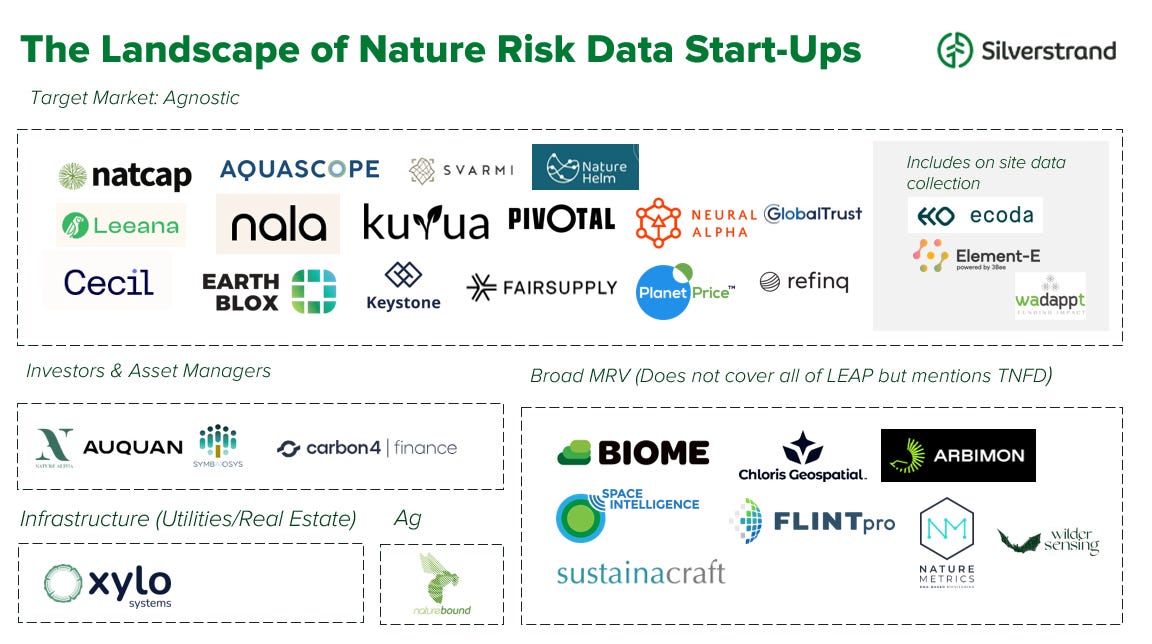

What use cases are most pressing today, you might ask? Here are 3 major areas we’ve seen, and the ecosystem of innovators for each.

Note: The maps provided in this piece are meant to serve as broad guidance about the nature data space - there are likely overlaps for more than a few into different categories, and some degree of inaccuracies. We welcome constructive feedback!

1. Risk Data Analytics

Why it matters. Nature has an impact on business, and businesses have an impact on nature - what is known as “double materiality”. For example, a business’ manufacturing operations impact its surrounding environment from the way it manages wastes and uses surrounding resources. However, issues like water quantity and quality access, as well as the availability of ecosystem services (such as pollination, if they rely on pollinated crops in their supply chains) also have material impacts on their ability to operate, and ultimately, their bottom line. If not managed, our changing environment poses a significant risk to businesses. Nature risks are also more than just physical - they can also come in the form of transition and liability risks, such as the risk of being sued for wildfire negligence.

Frameworks like that of the Taskforce for Nature-related Financial Disclosures (TNFD) are providing guidance for corporates to undertake the process of understanding their dependencies and impacts on nature, as well as formulating strategies to manage both - but the availability of data to execute against the framework is a pain point felt across sectors.

In a nutshell. Nature risk datasets encompass, in the first instance, a wide range of environmental indicators that help provide a holistic view of the ecosystem condition, extent, and pressures, such as land-use change, pollution, ecosystem services, and climate-related factors. Strong nature risk analytics match this environmental data to business operations data, including supply chain information, or data from a company’s own managed sites (to “identify the nature-business interface”). At the highest level, nature risk analytics can provide insights into risks under different scenarios.

The players. This is a very nascent, but rapidly growing space, given that the Global Biodiversity Framework was only ratified a couple of years ago and TNFD released just last year. Xylo Systems and Naturehelm are among some of the players working in this space, with most going for a broad range of sectors rather than a targeted industry.

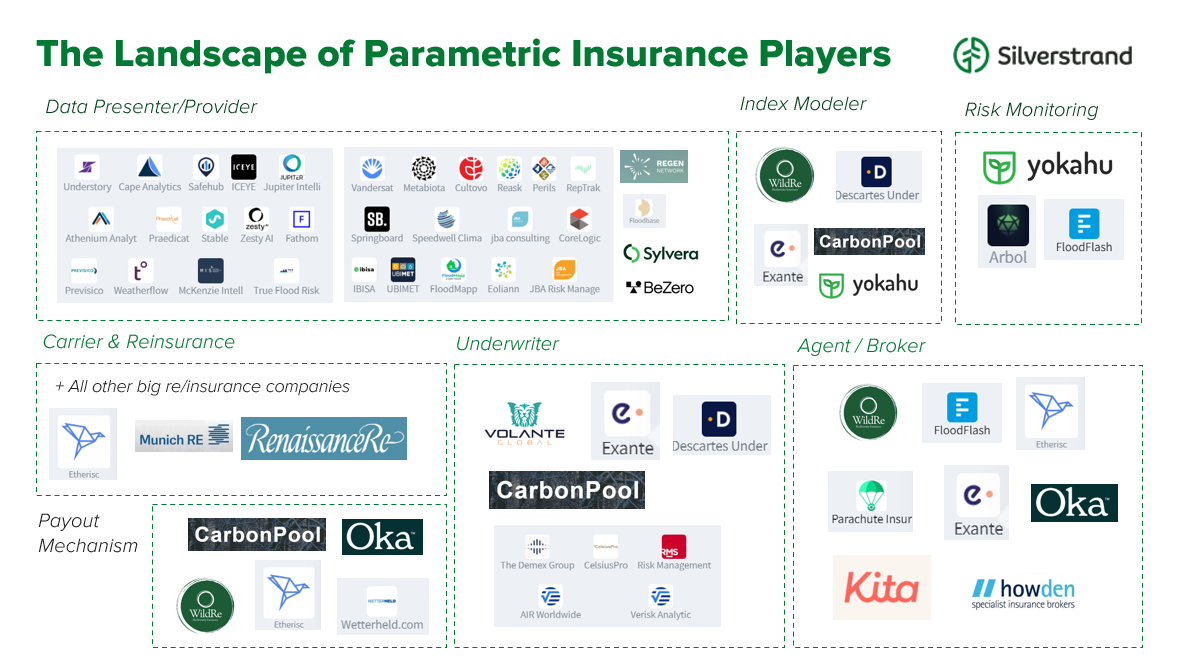

Parametric Insurance

Why it matters. After facing catastrophic disasters such as devastating floods, the last thing that any victim would want to do is file an insurance claim on their damaged property and await delayed investigation before they can start rebuilding their lives. As climate change and human fallacies have exacerbated the frequency and intensity of such “natural” events, there’s a clear need for us to find ways to respond better.

There is also a lack of capacity or appetite from traditional insurance markets for nature-based project teams solutions, but managing teams need to access resources quickly to help mitigate losses during crisis (e.g. to start replanting quickly after a fire), which may be a time-sensitive challenge.

In a nutshell. Fundamentally, parametric (or index based) solutions “are a type of insurance that covers the probability of a predefined event happening, instead of indemnifying actual loss incurred” (Swiss Re). In simpler terms, parametric insurance is designed around:

A trigger event that can be modelled, such as the spread of fire, with a pre-determined threshold, say, the fire touching the border of a property when viewed from satellite imagery. This is just one example of an application of parametric insurance, but there are many other potential applications, such as Swiss Re’s coral reef insurance.

A pay-out mechanism once the insurance cover is triggered by the pre-defined threshold being met (or exceeded), so that the people who need it most can access the resources they need quickly.

For parametric insurance, index and correlation modelling is a linchpin to an effective risk pricing and coverage.

The players. A number of startups are emerging recently as a complement to larger insurance companies - whether that’s through having strong risk modelling capabilities to model the trigger events, or balancing assets and liabilities through payout management and risk transfers.

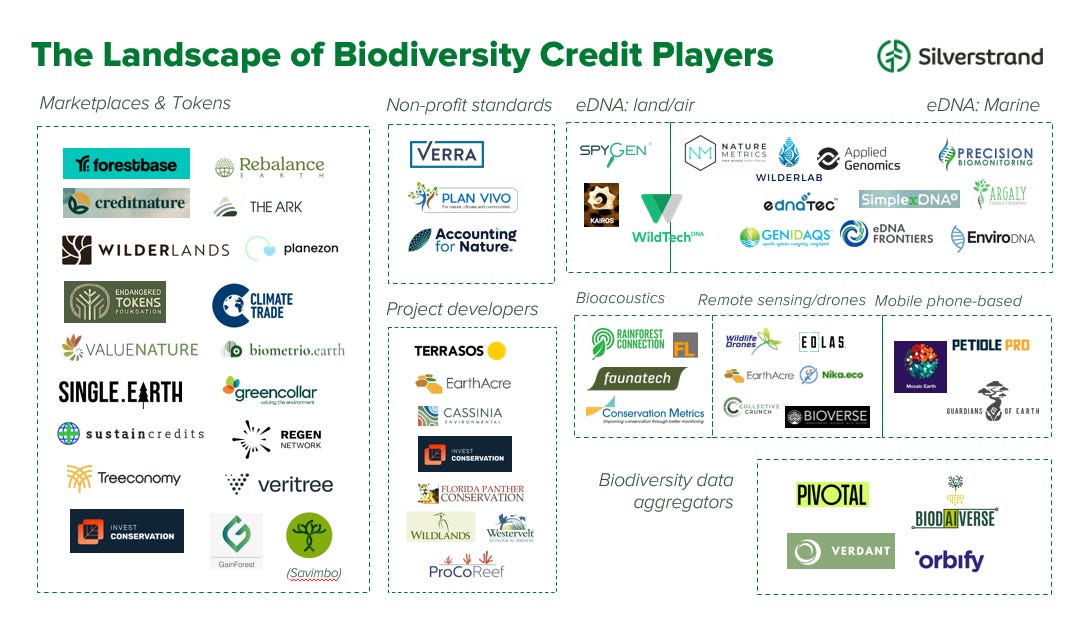

Biodiversity Credits

Why it matters. The private sector needs to do more to fill the nature financing gap, contributing only 18% of all NbS funding today and with the UNEP estimating that annual NbS investments need to triple by 2030 to achieve Rio targets. Carbon markets can provide financial incentives for private landowners to restore and conserve nature, but they have their limitations. For example, coral restoration projects cannot produce carbon credits, since they don’t sequester a huge amount of carbon. As another example, carbon NbS projects can take the form of monocultures or have intensive fencing structures, which can be good for carbon storage, but not for biodiversity outcomes.

In a nutshell. There are a number of organisations working to lend their technical know-how to build the methodologies and measurement schemes for the biodiversity credit market. One popular concept is taking a “basket of metrics” approach. Similar to how an index like CPI might work for tracking economic change, we can conceive of ecosystem integrity indices composed of a number of representative metrics, including those related to habitat fragmentation, ecosystem services, and to keystone species.

In addition to ecosystem and species state and pressure metrics, some players, such as EarthAcre, are also building data systems to ensure that IPLCS are included as meaningful stakeholders and beneficiaries of the market.

The players. As in the carbon market, on the supply side the biodiversity market is made up of project developers (like Terrasos and EarthAcre), standard setters, Measurement, Reporting & Verification (MRV) providers (like Nika.eco and Bioverse), and marketplaces, (like Wilderlands).

Thanks for reading, and until next time 👋🏼

Think there was something we missed? Let us know in the comments!