From Genetic Data to Global Dividends: Will the Cali Fund Live Up to Its Promise?

Much of the global economy depends on nature's genetic resources to thrive. The Cali Fund aims to distribute corporate profits to protect it. We look at what it might mean for nature tech.

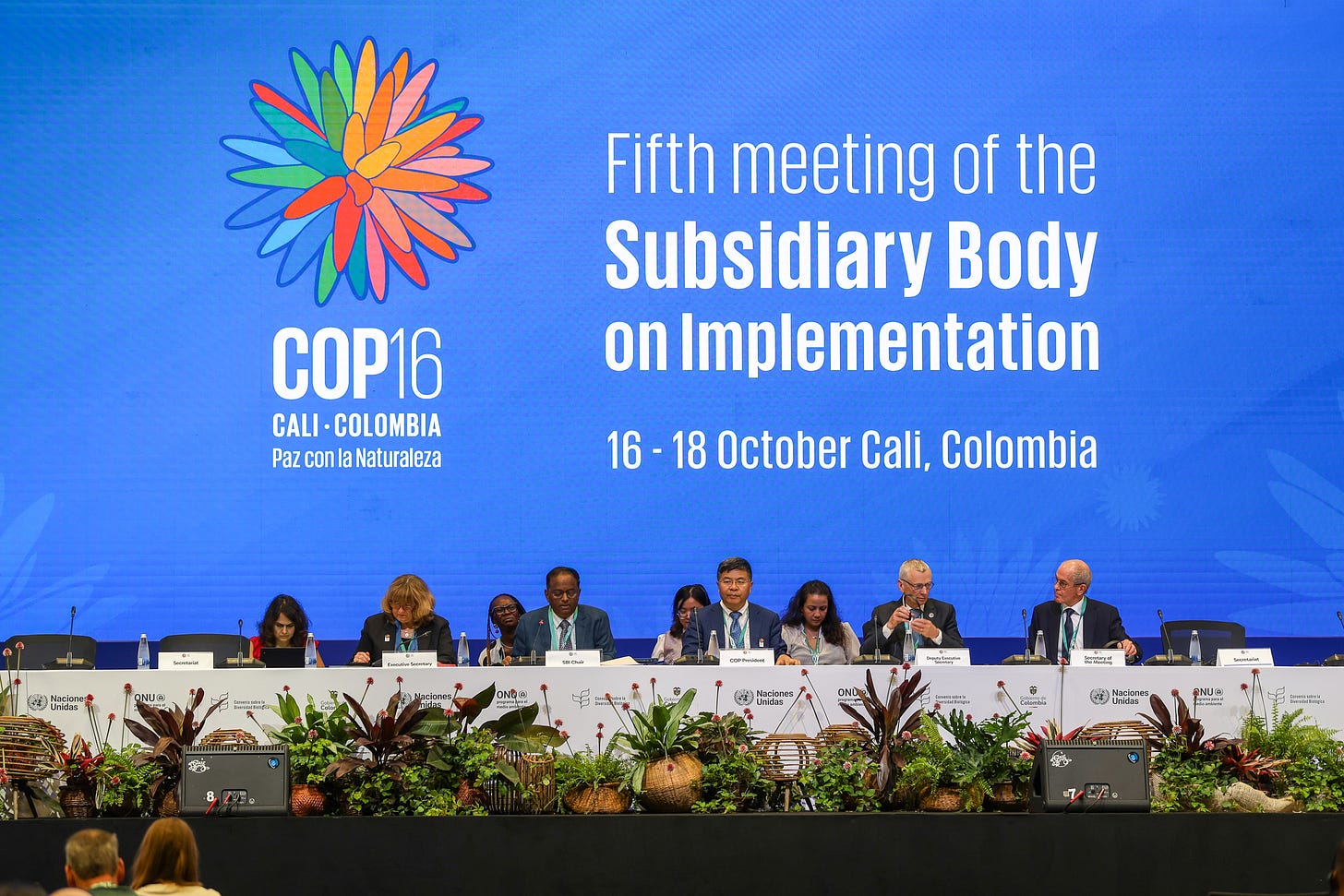

(Photo above by IISD/ENB | Mike Muzurakis)

COP16 has come and gone – and yet, the outcome of global deliberations for biodiversity are far from certain.

Take the Cali Fund for instance. A UN-controlled global fund announced at COP16, it seeks to make the corporations that benefit from nature’s genetic resources – think agriculture or pharmaceuticals, as examples - contribute a portion of their profits to conserve biodiversity and uplift the communities that do so. Its proponents say it can make up to $1 billion yearly for the cause, with half going to indigenous peoples and local communities.

For some, it certainly presents a seeming alternative to the nature-based carbon markets, with sizable payouts - Mongabay reported that if the Cali Fund had been in effect during the COVID-19 pandemic, Moderna would have paid $30 million out of the total $30 billion it made in vaccine sales. With 1,700 major gene banks around the world housing over seven million samples for agriculture alone, our existing reliance on genetic data is clear.

Pictured above: Penicillium chrysogenum, the soil fungus species that is the source of the antibiotic penicillin (Credits to Anne Bahnweg from Cambridge University)

However, neither the method of enforcement for the fund nor its distribution mechanism has been agreed upon – two of the most important elements for the success of such a fund.

Even as we await the finalization of the above details, what we do know is this:

1) Firstly, Data Sequencing Information (DSI) (what policymakers call the data derived from genetic resources) has played a pivotal role in important fields like nutraceuticals, synthetic biology, and agriculture.

The wild relatives of crops have, for example, been estimated to improve food production by an annual value of US$115-120 billion worldwide, as they’ve been a source of genes to develop resistance to unprecedented pests and disease, enhance nutritional quality, and provide tolerance to extreme weather and climate change. The biodiversity crisis and consequent loss of global DSI present one of the clearest forms of nature risk. Smart, forward-looking corporates should already be concerned about the biodiversity crisis, and its impacts on its future balance sheets, actively working to protect the nature their supply chains depend on.

Pictured above: Solanum demissum, a wild potato species from Mexico whose genes were critical in breeding potato varieties that can resist late blight, the disease associated with the Irish Potato Famine. (Photo credits)

2) Secondly, the allocation mechanism of the Cali Fund will consider the biodiversity richness of the recipient country or location.

For us at Silverstrand, this is a topic of particular interest, given the rich biodiversity of Southeast Asia that remains tragically underfunded. Several global pharmaceutical and agriculture companies actively operate in the region, and the under-documented DSI of SEA presents a double-edged sword: At once a magnet for over-exploitation, yet also an opportunity to attract new private funds for nature. We call on the governments of this region to ratify and start enforcing to companies to contribute based on DSI usage, in the spirit of the Cali Fund agreement, nationally. They must also issue complementary regulations that ensure that distribution of the fund goes to conservation and local community. Local communities must feel and understand such programmes too through active dialogue and education. Besides enforcing an obligation, also give companies incentive to invest more in the local biodiversity, e.g. tax holiday, special economic zone or sandbox for synthetic bio or production, and ensure that academic institutions are supported to generate key R&D breakthroughs.

Pictured above: Photo from Basecamp Research, which dispatches scientists to Antarctica and other remote corners of the world to search for proteins in nature that could benefit companies in industries such as healthcare, nutrition and cosmetics. The company partners with biodiversity partners across the globe to help share the financial benefits of its work with local communities.

3) Lastly, technologies such as artificial intelligence and eDNA/RNA are set to shorten the time needed in the innovation biology cycles further.

Predictions on sequencing, gene isolation, design, modification of molecular structures, gene expression, and other chemical, physical characteristic outcomes are enabled through machine learning and simulation. Repetitive experiments can be run in a computer instead in a physical lab. This is also all thanks to the new availability of big genetic resources data, sourced by companies such as Basecamp Research. Technologies like Basecamp’s may hold some of the keys for enabling a clearer and transparent distribution mechanism for the Cali Fund, as the company already contributes its data through access and benefit sharing partnerships with over 100 biodiversity organizations in over 20 countries across the globe.

If you’re a founder working in the nature conservation and/or nature tech space, the question that you may be asking yourself is this: Is the Cali Fund going to accelerate investment for biodiversity? And to us, the honest answer is that on its own, it’s too early to tell. Relying on the Cali Fund as the sole enabler of your business succeeding risky, and there’s no replacement for finding true product-market fit.

But the optimistic take on this situation is that this announcement has only reinforced the importance of DSI, which remains an existential threat for many corporates - and that’s a market driver worth focusing on. We hope to see more companies, big and small, recognizing the value of DSI and contributing to its protection and restoration.

If you are a company working in nature DSI, we would love to hear from you. Reach out at https://www.silverstrand.capital/contact