Insetting 101

The role of technology and innovation to slash industrial emissions, beyond carbon offsets. Presented in collaboration with Wavemaker Impact.

This post is a summary of a three-part series published to the Silverstrand Capital and Wavemaker Impact Linkedin pages. The original posts, which are more visual in format, can be viewed here: 1, 2, 3a/3b. Be sure to follow to be the first to read more like this in the future.

Insetting: What is it?

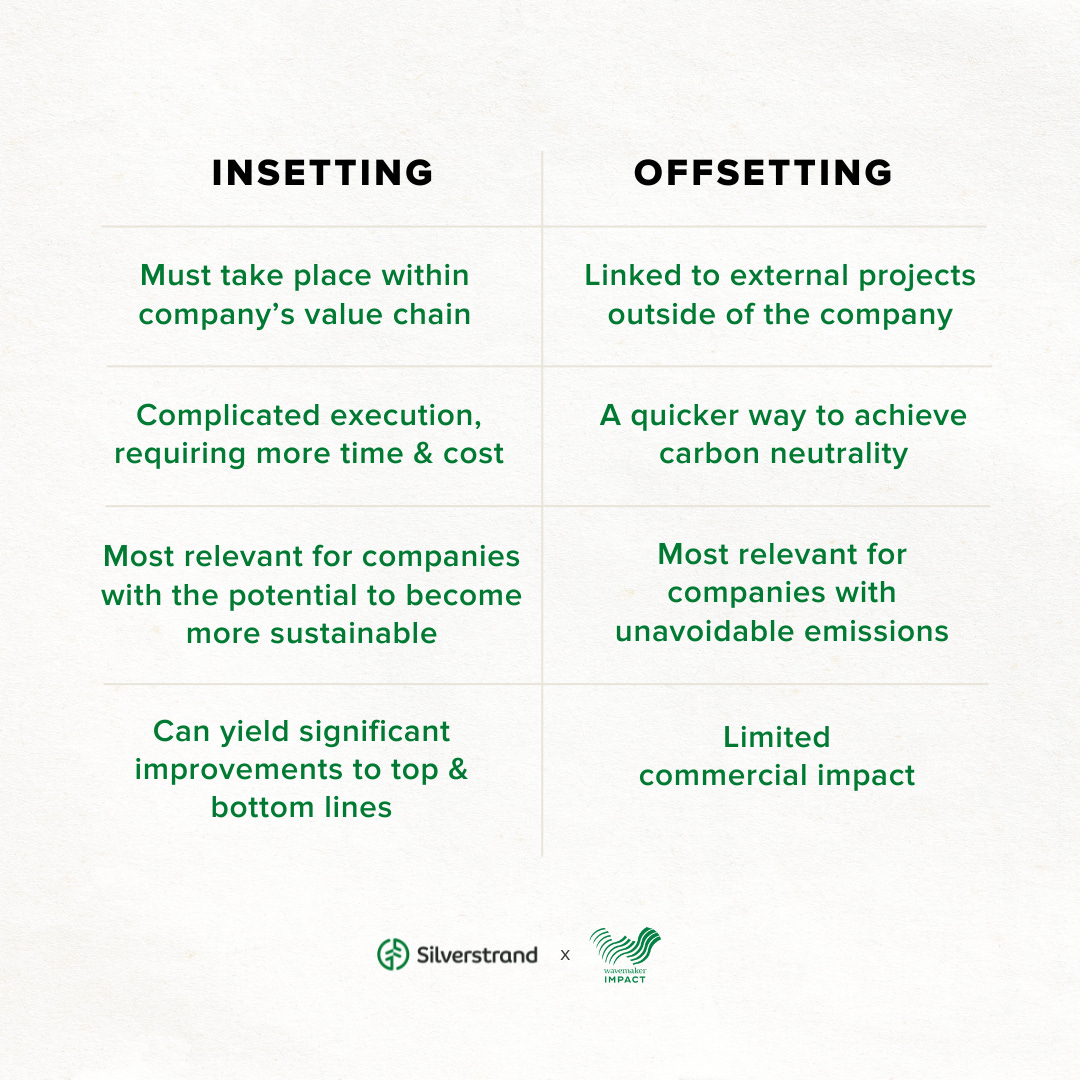

Put simply, insetting is a sustainability strategy for companies to reduce carbon emissions within its own operations & supply chain (as opposed to carbon offsets, which are purchased from external projects).

Implementing an insetting strategy could look like adopting more sustainable procurement practices, or investing into climate friendlier infrastructure. For example, a company which makes ready-to-eat meals might purchase its ingredients from local suppliers using regenerative agricultural practices that store carbon in the soil, invest in renewable energy grids to power its manufacturing activities, and upgrade it equipment and facilities to improve energy efficiency.

This approach has strong appeal as a complement to offsetting, because it targets the root causes of global emissions, and can also yield long-term value-chain savings.

The State of Insetting Commitments in the Market

Insetting claims date back over a decade, but they have surged in popularity in the last few years as offset-based net-zero strategies come under fire, and insetting has become a more attractive alternative (See here for Shell’s withdrawal of it’s $100M carbon offset plan, for example). Food and ag players such as Nestle, Unilever, Walmart, and Pepsico are among some more the more notable players adopting insetting sustainability strategies.

But while insetting holds promise, some key challenges remain that threaten its credibility, namely:

Insetting claims aren’t immune to green washing, especially because there isn’t a widely-accepted verifying body that validate claims. In this sense, insets risk being even weaker than offsets, which are governed by bodies like Verra, using standardised methodologies designed in consultation with scientists and the public, and with independent auditing. To be clear, industry guidelines do exist, such as those set by The Insetting Program Standard (IPS), and the Science-based Target Network (SBTN), but their use does not require independent checks on the data and claims reported.

Supply chains aren’t always transparent, and their transformation requires influence over market stakeholders, which corporates may not always have. Fragmented supply chains with many middlemen, and low technology adoption, can mean top-down practice change challenging to actualize.

If not done managed intentionally, suppliers may end up inequitably bearing the brunt of the cost of the insetting transition. Buyers that buy

majority volumes from suppliers may have enough power to demand practice change from them, without compensating them for doing so. If the threat of loss of their livelihoods, suppliers may have no choice but to absorb the cost of transitioning to less carbon-intensive practices.

So - how can we unlock the insetting opportunity and avoid such pitfalls?

The Role of Technology & Innovation for Insetting

New businesses can help transform supply chains across industries in a number of ways: by providing training and capacity building to relevant stakeholders, by fairly distributing financial rewards to responsible supply chain actors, by making supply chains more transparent with digital ledgers and credible measurement technologies…. the list goes on.

Two companies in the Wavemaker and Silverstrand portfolios exemplify this: Rize and Koltiva.

Rize - Reducing emissions and water use for rice cultivation in Asia

Founded in 2023, Rize is an agri-tech startup formed through a joint venture between investors Temasek, Wavemaker Impact, Breakthrough Energy Ventures and GenZero to decarbonise rice cultivation in Asia. Starting in Vietnam and Indonesia, Rize’s mission is to transform rice into a sustainable, lower emission food source while enhancing the livelihoods of farmers - and to eliminate 0.5 gigatonnes of carbon emission units by 2040.

To do so, the Rize team is building a technology platform which addresses the challenge for farmers to change their practices: the lack of financing and access to organised credit to implement more sustainable actions. Many rice farmers already face intense financial pressures from high interest rates, high input costs, and the high risk of crop failures. Rize’s platform:

Identifies the most effective carbon insetting strategies to reduce greenhouse gas emissions in rice cultivation

Provides farmers with cheaper input financing to encourage the adoption of these sustainable cultivation techniques.

Supports farmers in implementing new methods like Alternative Wetting and Drying (AWD), and biological nitrogen-fixing (BNF)

As a result, Rize has successfully supported 2,500 hectares of rice paddy farmers to reduce their emissions by up to 40% and reduce their water inputs by up to 30% - while also increasing their income by up to 30%.

Koltiva - Enabling Inclusive & Climate-Smart Agriculture, for People and the Planet

Koltiva is a technology company with a “boots on the ground” team and a big ambition: to improve supply chain traceability, provide incentives & benefits for smallholder farmers that adopt sustainable practices, drive access to price transparency & digital finance for the unbanked and to facilitate the trade of climate-smart commodities. Going beyond traceability, the team combines professional services with a number of farmer applications and supply-chain oriented desktop software, to drive action at the heart of our agricultural systems: on the smallholder farm.

We’ve written about Koltiva’s services and products before, so if you want to take an in-depth read, check out our investment notes here. Since we wrote that, there has been an even greater push for corporates and financial institutions to source responsibly, such as the EU Deforestation Regulations.

To date, Koltiva has worked in 61 countries and registered 1.1M producers to effect change across 52 crops and commodities - increasing annual farmer incomes by 4x.

Many thanks to the Wavemaker team, and especially to Ben Ong, for their collaboration on this piece. This topic was one that resonates strongly with both organisations, and we are very grateful to be in such good company.

We’re on the look-out for founders and companies that share our interest in reducing operations and supply chain emissions. If you are early in your journey, reach out to Wavemaker. And if you’ve already started a company and are looking to grow with investment, we’d love to hear from you here at Silverstrand.

Thanks for reading! As always, if you enjoyed this read, we’d really appreciate it if you give us a follow for more like this.

About Wavemaker Impact

Wavemaker Impact is Southeast Asia’s first climate-tech venture builder VC firm, whose mission is to build a portfolio of companies that can abate 10% of the global carbon budget (5 Gigatonne). To achieve this, they partner with experienced entrepreneurs to co-found and fund 100x100 businesses - startups with the ability to abate 100 million tons of CO2e and achieve $100 million in revenue on an annual basis at scale.