💡Investment Notes: Why we invested in Goodcarbon

Ensuring access and financing for the right types of carbon projects, focused on communities and biodiversity co-benefits

To anybody watching, it’s clear that carbon credits have experienced many controversies since its inception. It’s been 60 years since decision-makers attempted to put a price on human-induce greenhouse gas emissions, but distrust of the market remains as abundant as ever. That carbon emissions can be offset by preventing emissions from other parts of the world has been a much-discussed mechanism. More recently, there are questions whether a carbon credit translates to any climate change mitigation at all.

However, carbon credits are still needed to help fill the >$300bn financing gap for Nature that is needed to meet Rio targets. They are one the most acceptable ways to finance mitigation efforts, and have survived through many ebbs and flows - a testament to the work that scientists, policy makers, and industry stakeholders have all put in collectively to grow and sharpen the market. And like it or not, monetary incentives are one of the most important drivers of organized actions today. If we want to intervene on anthropogenic climate change, we have to move the majority into action by rewarding good environmental stewardship.

Conversely, nature-based offsets are also amongst the most cost-efficient approach to bulk carbon sequestration (compared to, for example, direct air capture which researchers project will still cost between US$230-540 per tCO2e in 2050). In the road to net-zero, nature-based carbon markets are expected to reach US$10bn by 2030, or approximately 1/3 of the TSVCM pathway of voluntary carbon credit demand.

None of this is to say that the carbon markets aren’t a double-edged sword. This same drive for monetary value has also been the long-standing cause of rent-seeking projects, with market players treating carbon credits like commodities or financial derivatives. Thus, a good carbon credit is eminent now more than ever. At the end of the day, buyers want to be sure that their money is being used to pay for real and verifiable climate change mitigation efforts.

“Not just carbon, but good carbon.” Those are the words of Jerome Cochet, the co-Founder of goodcarbon, a nature-based carbon credit platform that provides intelligence on the market, connects corporations with high-quality carbon credits, and develops its own projects. Here’s why Silverstrand decided to back this company.

1. Ability & reputation for sourcing & developing high-standard nature-based carbon credits

Goodcarbon’s in-house project evaluation and credit assessment framework provides a holistic review of any nature-based projects, so that credit purchasers can have confidence in the credibility of the projects they back. The entire review consists of remote sensing, rating agencies, expert consults, site visits and stakeholder interviews, and centers on a community- and biodiversity-first approach in carbon sequestration project development. These assessments are updates on at least an annual basis. Only those projects that meet their strict requirements will be offered to their clients.

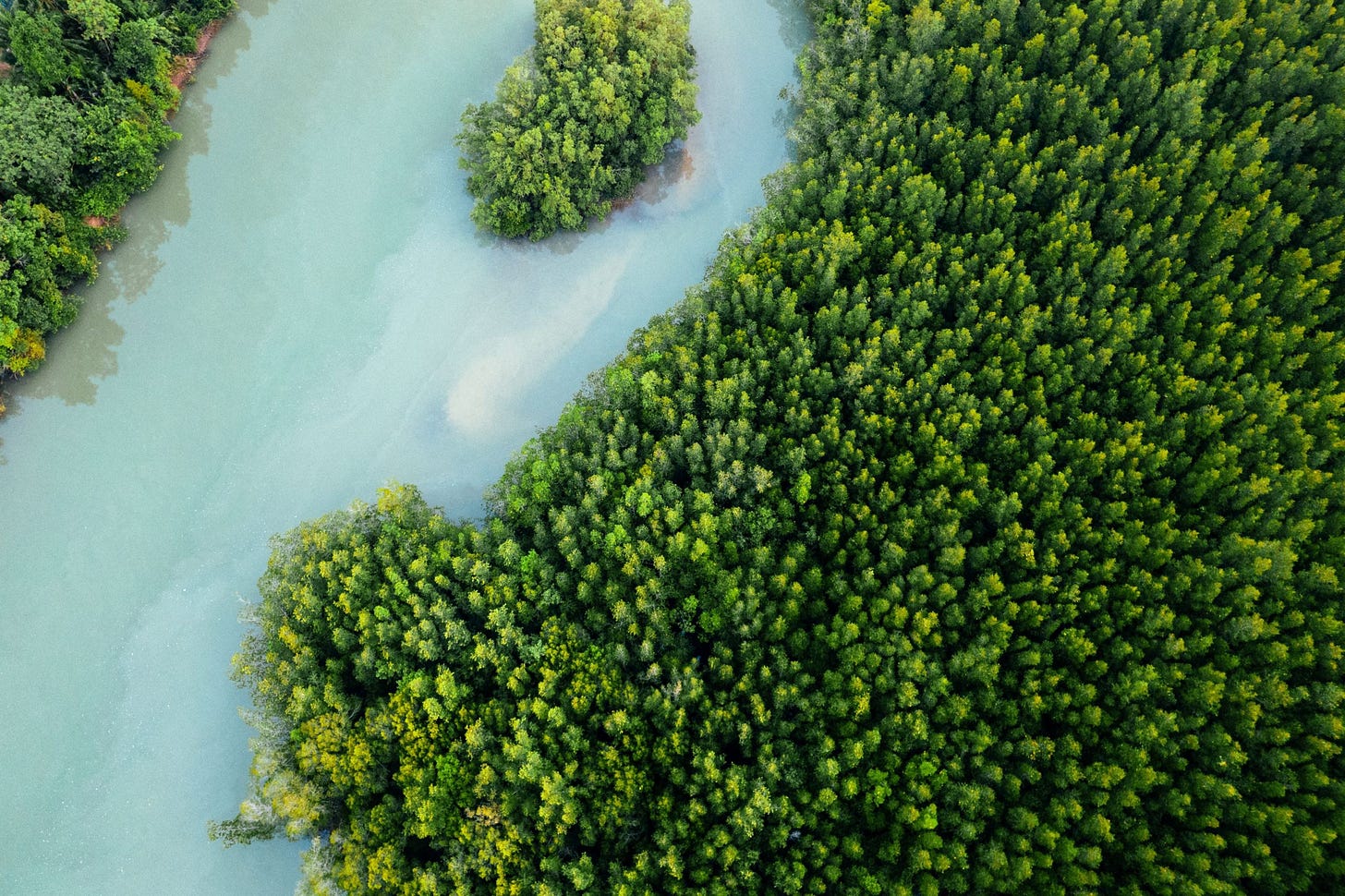

Beyond their assessments, and in line with their mission, goodcarbon is also beginning to develop its own projects, with a focus on the global South. Their first is a blue carbon project located in India, called the Green Wall of Gujarat, which involves stakeholders on the ground, including the NGO VIKAS Centre for Development.

As an indication of their credibility, they count a number of reputable organizations amongst their clients, including Conservation International, GIZ, Deutsche Telkom, and SAP. Our reference calls with select clients revealed that they are very satisfied with goodcarbon’s approach and assurances on providing high-quality carbon credits, and in some cases, goodcarbon has won contracts against 50 other proposals.

2. Strong year-on-year growth

Since its founding in 2021, goodcarbon has shown extremely strong revenue traction despite the intense saturation of competitors in the market.

The co-founders at goodcarbon, serial entrepreneur David Diallo and ex-management consultant Jerome Cochet, have showcased a clear and structured pathway of client acquisition and lifetime value optimization with a strong sales funnel and demonstrated understanding of market pain points. We expect their approach to allow them to continue capturing market share.

3. Like-minded co-investors such as Planet A and Ocean 14 Capital.

Goodcarbon has a number of respected investors on their cap-table, including early support from Planet A, a EUR 160m impact fund focusing in European green startups.

This latest round was led by Ocean 14 Capital, a high-conviction investor who has expressed a willingness to chip in more into project development and provide hands-on support to the company as it grows. In a market like this, with long and costly development timelines necessary to realize real impact, access to support like this should not be taken lightly.

All in all, we at Silverstrand are supporting a company that we believe are able to effectively allocate capital to good quality nature restoration and conservation.

Thanks a lot for reading! If you enjoyed these notes, do share it with your network, and follow us for future updates.

If you’re interested to learn more about goodcarbon, visit their website, follow them on Linkedin, or reach out to their team (or ours) for more information.

Until next time!