💡 Investment Notes: Why we invested in the Carbon Growth Fund II

Restoring and protecting landscapes at scale with high integrity carbon credits

As you may already know, last year, Silverstrand made an investment into the Carbon Growth Partner’s Carbon Growth Fund II, whose portfolio includes a variety of nature-based verified carbon credits issued by Verra, the Gold Standard Foundation, the Climate Action Reserve, and more.

Given our focus on biodiversity, some might ask - why invest in the carbon markets? Criticisms of the carbon market abound, and we are cognisant that the market can sometimes lean on a narrow perspective of what “sustainability” really means.

But we are also cognisant that the climate crisis is already having a massive impact on the world’s remaining non-built environment, whether in the form of the terrible fires ravaging Lahaina, deadly floods in China, or the slew of other disasters that have been felt across the globe.

Even as the private sector looks for solutions to to decrease their negative impact on biodiversity and nature broadly, the time to act is now.

Carbon credits and offsets are the most mature and immediate means for companies to contribute to fighting the climate crisis and restoring nature. They’ve undergone immense scrutiny and revision since the Clean Development Mechanism was first established during the Kyoto Protocol in 1997, and high investments into the measurement, verification and reporting technologies and frameworks mean that they are more transparent and credible than ever.

Considering practical limitations that slow the transition to a more sustainable economy, as recognised by major aviation and mining companies, it is critical that we not let perfect get in the way of good. This is not a zero-sum game. Rather than a “reduce emissions, then offset” mindset, the state of financing for nature today demands that we pursue a “reduce and offset” strategy if we want to limit climate change to below 1.5°C.

In the words of CGP’s CEO Rich Gilmore: “While carbon credits are only band-aids, they are necessary band-aids that will slow down the bleeding dramatically.”

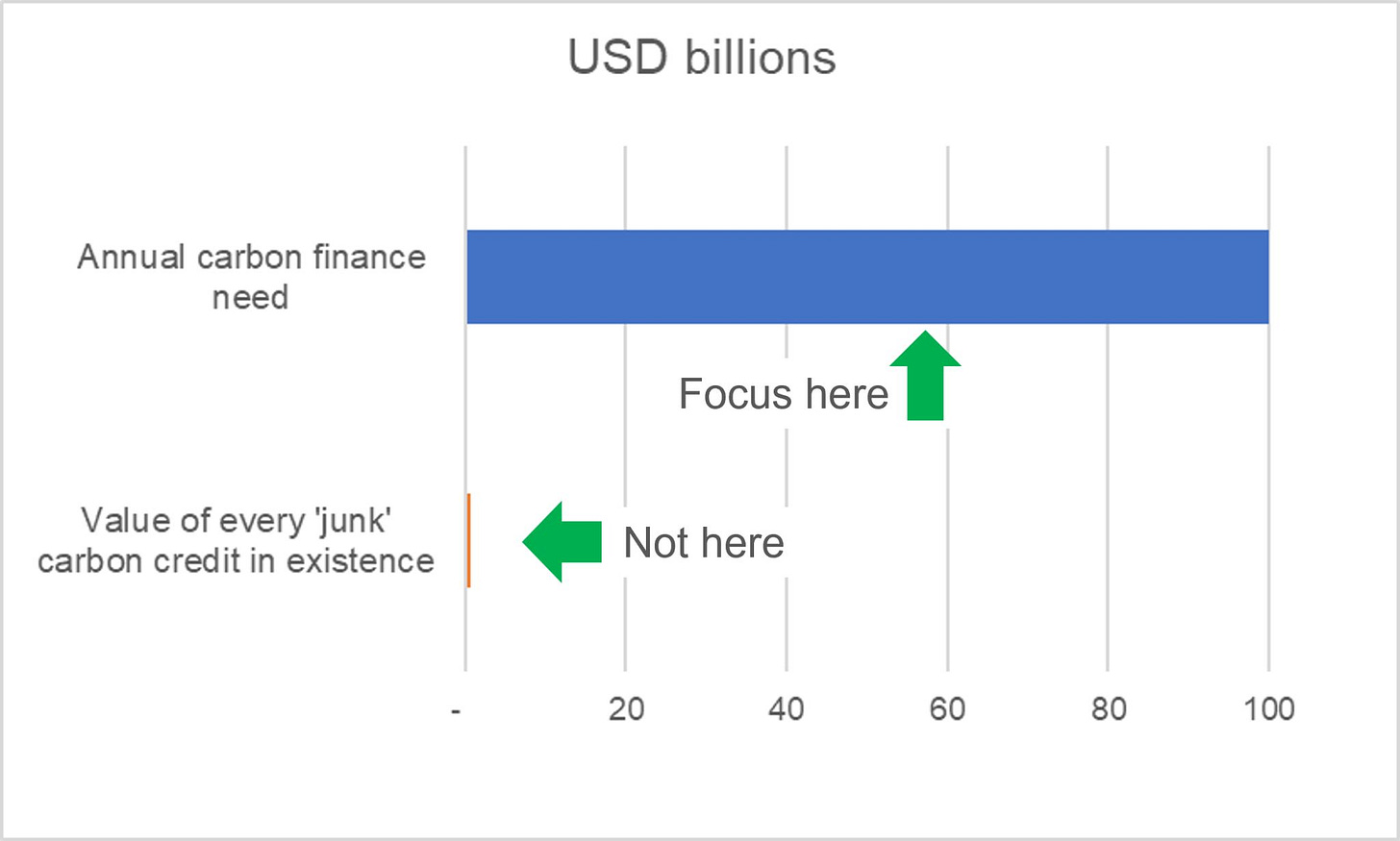

Figures above taken from this Linkedin Post by Rich on Carbon credits vs corporate emissions, and the problem with common narratives on the carbon markets

Here are three reasons why we have high conviction in our investment in the Carbon Growth Partners team:

1. Demonstrated long-term commitment to nature, local communities, and high quality credit standards

The CGP’s team comprises of industry veterans with combined expertise in conservation, capital markets, and regulatory environmental markets, to execute on their strategy to create nature-positive outcomes.

We believe in the team not only on the basis of their financial acumen as fund managers, but also from the fact that the team has been driving impact long before the hype around the carbon markets came to be. Prior to their time at CGP, for example, both Rich and Chief Impact Officer Charles Bedford served at The Nature Conservancy (TNC) for almost 7 and 20 years respectively. As the Australia Country Director for TNC, Rich originated over $100 million in natural capital impact investments. Charles, as TNC’s Regional Managing Director for APAC, led the advancement of climate, marine, freshwater and land conservation projects.

Pictured above: BlueMX mangrove restoration project supported by CGP. Learn about other CGP-supported projects in their 2022 impact report.

The team’s commitment to impact is evidenced in their rigorous investment screening process and criteria, with analyses assisted by independent rating agencies such as Sylvera and BeZero, as well as an extensive network of due diligence partners, project owners, developers and brokers. CGF-supported projects have to be have at least one co-benefit certification, such as the Verified Carbon Standard’s Climate, Community & Biodiversity Programme, and have a benefit-sharing mechanism in place with local communities, with demonstrated FPIC+. They must use peer-reviewed scientific modelling and project design, and be supported by local, provincial and/or national host governments. Importantly, the fund invests into projects at the optimal risk-return weighted price, and not the lowest possible price for the people on the ground.

2. Clear fund strategy driven by fundamentals, leading to outperformance of carbon market benchmarks

As anybody tracking the carbon market can tell you, it is a continually evolving market that has fluctuated greatly over the past few years.

However, the CGFII is driven by a strong underlying investment thesis that (1) there is a sizeable structural shortage of high-quality, nature-based credits, and (2) that voluntary demand is not in fact ‘voluntary’ but mandatory given the net-zero movement, which should drive prices higher longer term.

In its short-term day-to-day operations, the CGP team also keeps a close eye on real-time market trends, with analyses across carbon credit types, country policies, and more. The team has demonstrated a good understanding of the market to predict market preferences, allowing their funds to repeatedly outperform the benchmark S&P Global Voluntary Carbon Liquidity-Weighted Index.

3. Industry leadership

The CGP team engages actively in the discourse on the carbon market with its supporters and dissidents alike, to produce a healthy debate to strengthen and grow the industry. Besides social media, it hosted and spoken at a number of industry events, including the recent Carbon Market Institute Investor Forum in Singapore, panels on carbon pricing in the VCM with Climate Impact X. They have also published a blog of guides on the carbon markets and written op-eds published in third-party media such as Nikkei Asia.

With their experience investing over US$230 million in 96 projects across 27 countries, the Carbon Growth Partners has enabled the verified reduction or removal of 37 million tonnes of greenhouse gases. Silverstrand Capital is proud to support them as they continue to expand this important work.

Interested to learn more on the debate around carbon markets for nature? Check out some of these excellent posts and articles:

Visual Capitalist:

Rich Gilmore:

Josh Margolis:

Read more about the Carbon Growth Partners at their website and Linkedin, as well as their feature on the Silverstrand Linkedin. If you enjoyed these notes, please consider sharing it with your network and subscribing for future updates.